Share

IMPORTANT: WE ARE RECEIVING MORE AND MORE CALLS FROM TRUCKERS STATING THEY ARE RECEIVING CALLS FROM FACTORING COMPANIES THAT CLAIM THEY HAVE A SPECIAL AGREEMENT WITH THE COREFUND RECEIVER TO GET YOU RELEASED FASTER… THESE ARE SHADY TACTICS THAT ARE NOT TRUE. A COURT APPOINTED RECEIVER WOULD NEVER ENTER INTO SUCH AGREEMENT. AVOID THESE PREDATORY FACTORING COMPANIES. WHILE THERE ARE ONLY A FEW BAD APPLES, THEY DO NOT SPEAK FOR THE REST OF THE MANY MORE HONEST AND REPUTABLE FACTORS IN THE INDUSTRY.

*NOTE: LoadX Factoring was started by truckers, for truckers in order to help other truckers and help them avoid predatory factoring companies. Keep in mind that NO factoring company has the ability to get you immediately released from your UCC or NOA as it stands right now. Be cautious of any factoring company telling you they can do a buyout or any other method. Normally, this would be an option. But a buyout, or any other type of method through normal means, is impossible right now because there are no staff to process this. Currently we are all at the mercy of the court system, CoreFund attorneys, and CoreFund’s owners.

Update: Wednesday 8/3/2022, 5pm cst

According to the receiver, all CoreFund staff are back in the offices today and working with the receiver to begin to reconcile accounts and payments. The receiver stated the goal is to have this done by the end of this week, Friday 8/5/22. At that point they will be able to begin the process of terminations. Attorney Jason Medley also stated his team has an emergency order ready to be filed Friday night if it doesn’t look like progress with terminations have been made.

The receiver also stated that they are fine with clients calling their CoreFund account executive and requesting a buyout as well. CoreFund will want to try and keep you, but will not force you to stay even if your contract is not up for renewal yet.

Q. What if I have invoices that need to be sent in? Do I go ahead and send to CoreFund, or wait?

A. Wait. If you send them to CoreFund they will be placed in an already long queue. Unless you plan on staying with CoreFund, it is best to hold onto those invoice and send them to your new factor when you receive your release.

Q. Will I get released this week?

A. It does not look like it at the moment.

Q. Can I invoice loads directly and have the broker pay me?

A. If you have ever done a load for this broker in the past, they likely still have a NOA on file and will not pay you. If this is a new broker for you that does not have a CoreFund NOA then it is likely you can invoice directly and get paid.

Q. Can any other factoring company factor my loads right now.

A. Can they? Yes. Will they? Not likely. As with the previous question, if a factoring company does factor a load for you without a CoreFund release and new NOA then that factor may never get paid. There are some possible legal ramifications for the new factor as well. Can they factor new brokers? Possibly.

Q. Can any factoring company get me a CoreFund release faster?

A. NO! Unfortunately, there will be a very small number of factoring companies that may try and take advantage of the situation and make claims that are completely not true. Our best advise is to speak with an attorney.

The two attorneys we suggest are Jason Medley and David Jencks.

Update: Monday 8/1/2022, 5pm cst

LoadX Factoring has made contact with the receiver appointed by the court to act for CoreFund. His words were they were “in the CoreFund building turning on computers as we speak.” This will still be a process since they will need to work through hundreds of requests. More updates coming.

Major Update: Thursday 7/28/2022, 2pm cst

The hard part is over and the judge appointed a receiver in the CoreFund case. The receiver has the ability to act for CoreFund, meaning issuing releases, etc. It will take a little time for the receiver to get into the offices, get access to accounts, etc, but the hard part is over.

If you want to factor with LoadX Factoring the rate is 3.5% non-recourse, month to month, free same day and next day pay, no hidden fees. We won’t look for reasons to come back at you for money like everyone else does. Our credit checks are instant through our online portal. Paperwork is submitted easily through email. In fact our agreement is online for the world to see. We want to be transparent. We are truckers too who decided we were tired of the bad factoring companies so we started LoadX. This CoreFund issue is exactly why we started LoadX.

Our agreement: https://loadxfactoring.com/terms-and-conditions/

Our application: https://loadxfactoring.com/loadx-factoring-application/

No matter what you do, We will continue to be here to help you. Please watch out for the predatory factoring companies.

You can view the order here: https://hubs.ly/Q01hQDNy0

Update: Wednesday, 7/27/2022, 5pm cst

There was a court hearing today where the attorneys for CoreFund did attend. The parties involved argued over the appointment of a receiver and no ruling for a receiver was made. Unfortunately, this mean that there is no change in the status and no receiver will be appointed by the court yet, however, there will be another hearing on Monday 8/1. As of right now, NO FACTORING COMPANY has the ability to release you from your NOA or UCC. Please be careful with those saying they can. At this moment there is no way for a factoring company to arrange buyouts or releases until this is resolved.

Update: Tuesday, 7/26/2022, 11pm cst

A hearing is schedule for tomorrow, Wednesday 7/27/22. The court will consider appointing a receiver. If this is done, the receiver will be able to process buyouts and terminations. In theory, this would be a free process much like any normal day if you wanted to get out of your CoreFund agreement before any of this had happened. As soon as we know the contact information for the receiver, if one is appointed, we will post it here asap.

Update: Tuesday, 7/26/2022, 9pm cst

The following is from Todd Waller, former Business Development Officer at CoreFund Capital. As we said from the beginning, we stand with the great staff that made CoreFund the success it was. Truly a great group of people.

Many of you are now aware that CoreFund is currently closed due to an ongoing lawsuit and that all staff was terminated last week and is now legally unable to conduct any business whatsoever. Our team was amazing and worked hard to build a reputation of taking care of our clients and now through the deliberate and selfish/hurtful/evil actions of one person that has all been ripped away from us. Our staff is hurting and struggling with this as we were completely blindsided. Additionally we are saddened and sickened by how this is impacting our clients who we consider family and we are legally unable to do anything to help as they struggle to stay in business. Please know that every employee of CoreFund wishes more than anything we could have continued funding our clients and now that we could release them and end this awful mess but even if we terminated a UCC or sent a release letter it would not be enforceable given we are no longer employees of CoreFund. -Todd Waller

Update: Tuesday, 7/26/2022, 3am cst

See the below communication from Attorney Jason Medley’s office for anyone interested in hiring him for this.

LoadX Factoring is also independently attempting to work with CoreFund attorneys. Continued updates as they occur.

On Behalf of Jason M. Medley – CoreFund Update

Werner, Erin <ewerner@spencerfane.com>

Good Afternoon Everyone,

I have spoken to the attorney for CoreFund. If you provide me with your company name and contact information, we will be getting terminations of the factoring agreement, UCC3 Lien Terminations, Revocations of the Notice of Assignment to your account debtors/customers, and confirmation of any amount owed to CoreFund or owed to you by CoreFund.

If you are owed money, we will likely simply reserve our right to seek it later. This will expedite helping you move on to a new factor, without waiving the right to get your Reserves released (that will be step 2).

If you owe money, we will make sure that you agree on that amount and then we will consider making payment into the court registry or their lawyer’s trust account.

If this process runs as planned, our fees will be very manageable and divided among the group. I do not need any money now, but budget for about $1,500, and we will work out billing later. Feel free to pass this information along as you see fit.

Thank you everyone.

Werner, Erin <ewerner@spencerfane.com>

Update: Tuesday, 7/26/2022, 9am cst

Attorneys for CoreFund have indicated this morning they may file for voluntary bankruptcy or receivership as noted yesterday. This may be good news as it may allow for a faster path for removing UCC’s and NOA to allow clients to sign on to a new factoring company without issue.

Update: Monday, 7/25/2022, 5pm cst

Attorney Jason Medley will be filing an emergency intervention and involuntary receivership. This would allow a receiver to be appointed by the court allowing all Notice of Assignments to be revoked and UCC’s to be terminated.

We don’t have a timeframe on when the courts can take the matter up and rule, so it is recommended that clients proceed to send a 20 day UCC termination demand letter to CoreFund as we explained below under “§ 9-509. PERSONS ENTITLED TO FILE A RECORD.” Jason is able to send this demand letter for you if you request it. He will need 1) a copy of your CoreFund factoring agreement and 2) your original UCC1 filed by CoreFund against your assets. If you do not have this, Jason can pull it for you.

Ideally, these things happen and you are then free to move onto a new factoring company without issue.

Contact information for Attorney Jason Medley:

Jason M. Medley

Spencer Fane LLP

3040 Post Oak Blvd., Suite 1300 | Houston, TX 77056-6560

PH 281.352.6032

jmedley@spencerfane.com

Update: Saturday, 7/24/2022 8am cst

We hope the staff of CoreFund Capital are being taken care of. It is never an easy situation to deal with when something like this happens and people are out of work through no fault of their own. The ones who work daily at CoreFund are great people and we hope a resolution is found for their sake.

What we know

CoreFund Capital, a factoring company based in Weatherford, Texas, went dark the week of July 18, 2022 with no warning or communication to clients or the public. Everyone trying to call their account representatives or the general phone number were left getting only voicemails or “mailbox full” notifications.

LoadX Factoring was able to confirm through a top executive of CoreFund that all staff were fired, including executive staff, early in the week.

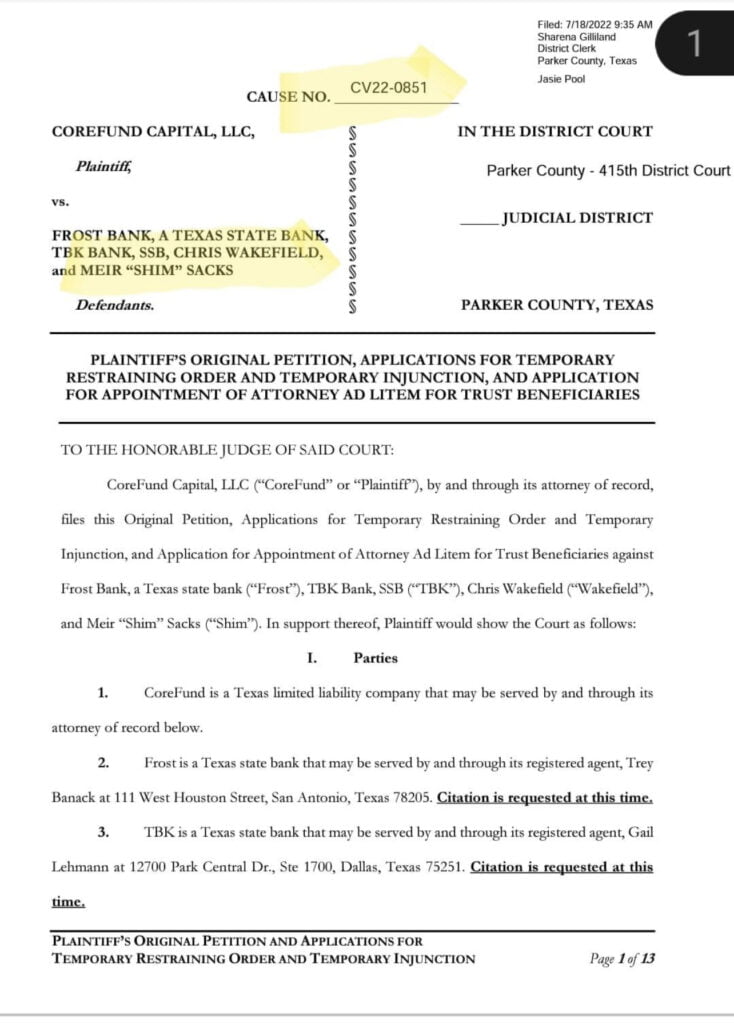

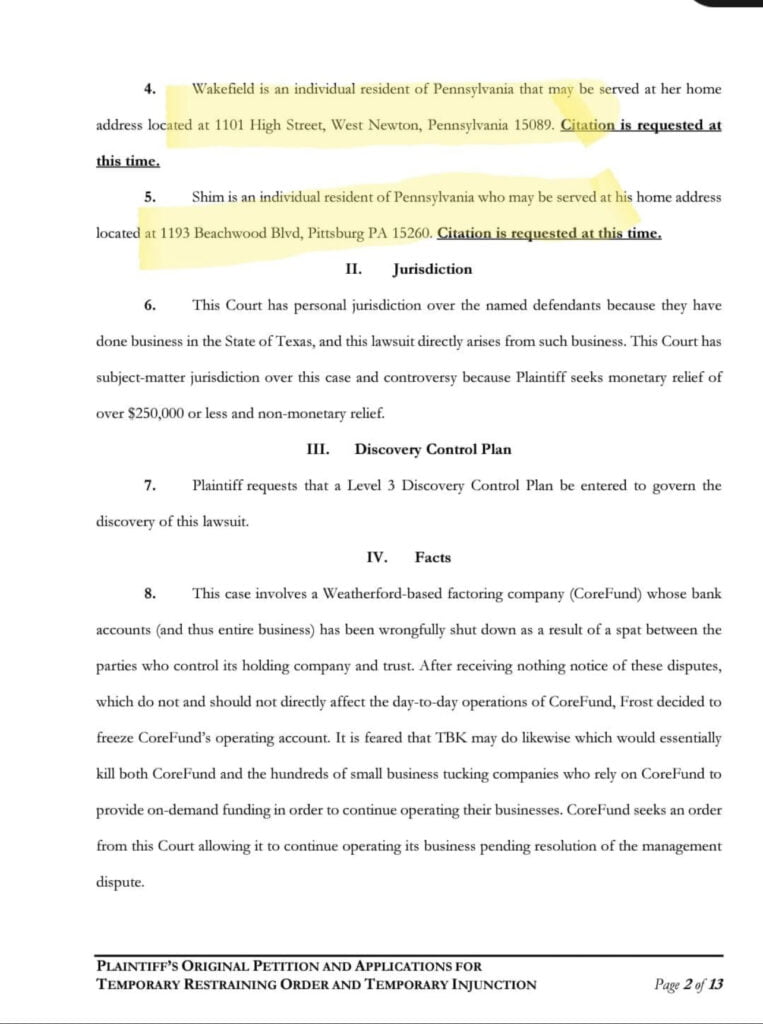

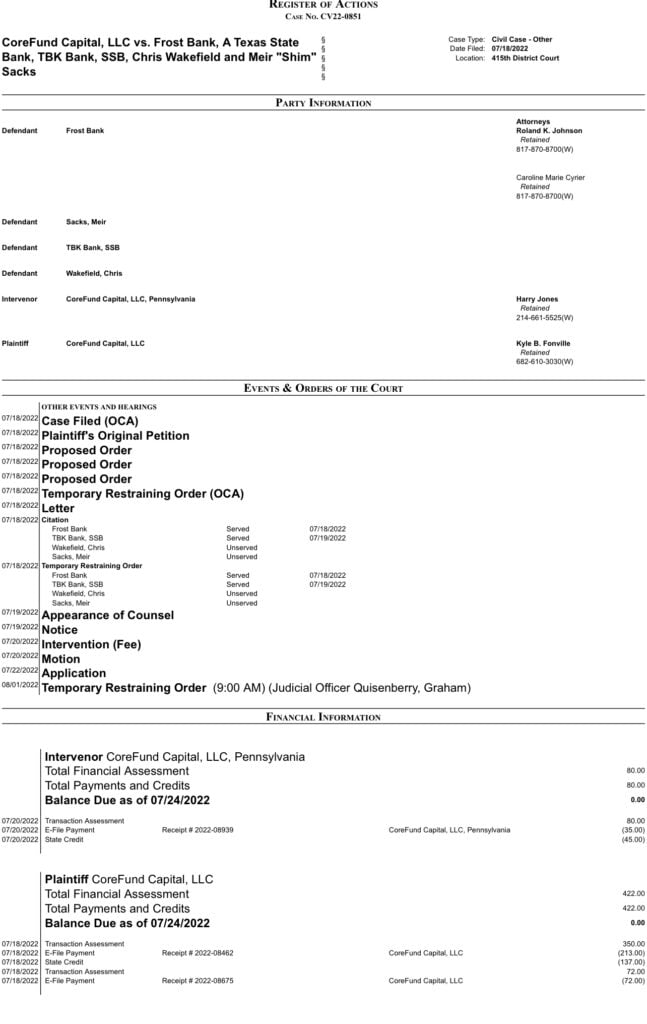

CoreFund Capital has filed a petition for a restraining order and injunction against Frost Bank, TBK Bank, Chris Wakefield, and Meir “Shim” Sacks. The petition states that CoreFund’s “bank accounts (and thus entire business)” have been wrongly shut down. Frost Bank did freeze CoreFund’s operating account, and CoreFund believes TBK Bank will do the same. The petition states that this is because of a “spat” between the parties who control CoreFund’s holding company and trust (Wakefield and Sacks). The petition is asking the Parker County, Texas District Court (Case No. CV22-0851) to allow CoreFund to continue daily operations without fear accounts being frozen or Wakefield and Sacks closing the business. As of 7/24/2022, Frost Bank and TBK Bank have been served, but Wakefield and Sacks have not according to court records. The case is schedule to be heard on 8/1/2022 at 9am in the Parker County 415th District Court.

CoreFund Capital lawsuit page 1

CoreFund Capital lawsuit page 2

CoreFund Capital lawsuit status

What can you do?

First, none of the information below constitutes legal advice, and you should consult an attorney. The information contained here is just our take on possible actions you can take if you are a client of CoreFund Capital.

CoreFund has filed a UCC on all clients. This is normal for factoring companies and acts as a form of protection for the factoring company in case of client or debtor default. UCC’s are regulated by law and all parties involved in a UCC filing must follow these regulations. Here are a few excerpts of this regulation that may be of use.

§ 9-401. ALIENABILITY OF DEBTOR’S RIGHTS.

(a) [Other law governs alienability; exceptions.]

Except as otherwise provided in subsection (b) and Sections 9-406, 9-407, 9-408, and 9-409, whether a debtor‘s rights in collateral may be voluntarily or involuntarily transferred is governed by law other than this article.

(b) [Agreement does not prevent transfer.]

An agreement between the debtor and secured party which prohibits a transfer of the debtor’s rights in collateral or makes the transfer a default does not prevent the transfer from taking effect.

Our Take: Even if your contract with CoreFund states that the transfer of rights is prohibited (a new factoring company takes over in case of default), this section does not allow such prevention.

§ 9-406. DISCHARGE OF ACCOUNT DEBTOR; NOTIFICATION OF ASSIGNMENT; IDENTIFICATION AND PROOF OF ASSIGNMENT; RESTRICTIONS ON ASSIGNMENT OF ACCOUNTS, CHATTEL PAPER, PAYMENT INTANGIBLES, AND PROMISSORY NOTES INEFFECTIVE.

(c) [Proof of assignment.]

Subject to subsection (h), if requested by the account debtor, an assignee shall seasonably furnish reasonable proof that the assignment has been made. Unless the assignee complies, the account debtor may discharge its obligation by paying the assignor, even if the account debtor has received a notification under subsection (a).

Our Take: This section dictates that the account debtor (the client or a broker) can request from the assignee (CoreFund) reasonable proof that the assignment has been made (a Notice of Assignment). If CoreFund does not comply and does not send an NOA upon request, the debtor may discharge its obligation to pay CoreFund and may pay whomever they wish, even if CoreFund send an original NOA some time prior. Because CoreFund is closed and is not replying to any request, it is reasonable to assume they will also not be sending NOA’s upon request either this possibly allowing brokers to send payments elsewhere since they do not have a current NOA as requested.

§ 9-509. PERSONS ENTITLED TO FILE A RECORD.

(d) [Person entitled to file certain amendments.]

A person may file an amendment other than an amendment that adds collateral covered by a financing statement or an amendment that adds a debtor to a financing statement only if:

(1) the secured party of record authorizes the filing; or

(2) the amendment is a termination statement for a financing statement as to which the secured party of record has failed to file or send a termination statement as required by Section 9-513(a) or (c), the debtor authorizes the filing, and the termination statement indicates that the debtor authorized it to be filed.

Our Take: You can file an amendment to terminate CoreFund’s UCC filing against your company if CoreFund fails to file the termination. Keep in mind however that UCC Section 9-513 Termination Statement limits this ability if the financing statement on the UCC covers “accounts and chattel paper”. Most likely the financing statement in your UCC does include this. We have seen CoreFund client contracts and Section 21.1 “No Lien Termination without Release” also possibly limits this ability. If you would like to try this method you will need to send a demand for UCC termination to CoreFund via registered mail and wait 20 days. If CoreFund does not reply to the demand within 20 days, you may try to proceed with this method. All things considered, you can argue CoreFund is in default and the contract is no longer valid.

§ 9-625. REMEDIES FOR SECURED PARTY’S FAILURE TO COMPLY WITH ARTICLE.

(a) [Judicial orders concerning noncompliance.]

If it is established that a secured party is not proceeding in accordance with this article, a court may order or restrain collection, enforcement, or disposition of collateral on appropriate terms and conditions.

(b) [Damages for noncompliance.]

Subject to subsections (c), (d), and (f), a person is liable for damages in the amount of any loss caused by a failure to comply with this article. Loss caused by a failure to comply may include loss resulting from the debtor‘s inability to obtain, or increased costs of, alternative financing.

(c) [Persons entitled to recover damages; statutory damages in consumer-goods transaction.]

Except as otherwise provided in Section 9-628:

(1) a person that, at the time of the failure, was a debtor, was an obligor, or held a security interest in or other lien on the collateral may recover damages under subsection (b) for its loss; and

(2) if the collateral is consumer goods, a person that was a debtor or a secondary obligor at the time a secured party failed to comply with this part may recover for that failure in any event an amount not less than the credit service charge plus 10 percent of the principal amount of the obligation or the time-price differential plus 10 percent of the cash price.

(d) [Recovery when deficiency eliminated or reduced.]

A debtor whose deficiency is eliminated under Section 9-626 may recover damages for the loss of any surplus. However, a debtor or secondary obligor whose deficiency is eliminated or reduced under Section 9-626 may not otherwise recover under subsection (b) for noncompliance with the provisions of this part relating to collection, enforcement, disposition, or acceptance.

(e) [Statutory damages: noncompliance with specified provisions.]

In addition to any damages recoverable under subsection (b), the debtor, consumer obligor, or person named as a debtor in a filed record, as applicable, may recover $500 in each case from a person that:

(1) fails to comply with Section 9-208;

(2) fails to comply with Section 9-209;

(3) files a record that the person is not entitled to file under Section 9-509(a);

(4) fails to cause the secured party of record to file or send a termination statement as required by Section 9-513(a) or (c);

(5) fails to comply with Section 9-616(b)(1) and whose failure is part of a pattern, or consistent with a practice, of noncompliance; or

(6) fails to comply with Section 9-616(b)(2).

(f) [Statutory damages: noncompliance with Section 9-210.]

A debtor or consumer obligor may recover damages under subsection (b) and, in addition, $500 in each case from a person that, without reasonable cause, fails to comply with a request under Section 9-210. A recipient of a request under Section 9-210 which never claimed an interest in the collateral or obligations that are the subject of a request under that section has a reasonable excuse for failure to comply with the request within the meaning of this subsection.

(g) [Limitation of security interest: noncompliance with Section 9-210.]

If a secured party fails to comply with a request regarding a list of collateral or a statement of account under Section 9-210, the secured party may claim a security interest only as shown in the list or statement included in the request as against a person that is reasonably misled by the failure.

Our Take: Simply put, if the “secured party” (CoreFund) is not following the UCC regulations you have the right to file a lawsuit against them for damages incurred due to their failure to comply. A restraining order can also be requested to stop CoreFund from enforcing contract terms or penalties they believe they can asses if you proceed on your own without them with another Factor, etc. Again, there are some limits when it comes to “chattel paper” here but we believe there is still recourse by the courts to provide relief.

The issues with the contract

Now some of you may have noticed in your CoreFund contract Section 17.1.1(c) and (d). This section refers to defaulting on the contract.

Section (c) states that an event of default occurs when any guarantor fails to perform their obligations to Purchaser. An argument could be made that Frost Bank is a guarantor to CoreFund and they have frozen CoreFund’s account thereby failing to perform their original obligations to CoreFund.

Section (d) states that if the Purchaser deems itself insecure with respect to the prospect of repayment or performance of its obligations then this will constitute an event of default. Here an argument can be made that CoreFund did deem itself insecure and unable to perform its obligations through a series of Facebook comments made by its official Facebook account stating,

“We sincerely apologize for this situation and understand our clients who count on us are rightfully upset. We are doing everything in our power to restore things back to normal operations however we are currently unable to do so therefore we understand if our clients need to make other arrangements.“

CoreFund Capital Facebook Post, 7/22/2022 at 1:25pm cst

and another post stating,

“All, I would suggest you contact OOIDA. I have provided information to them in hopes they can also put pressure on Shim Sacks and Chris Wakefield, the parties responsible for shutting our doors with no plan of how to take care of the carriers. You can look up in public records the filing made in Parker County, TX. It not only details their actions, but also provides their home address.”

CoreFund Capital Facebook post, 7/23/2022 at 10:00pm cst

Because of the “event of default” the agreement can be terminated.

What is LoadX Factoring doing?

We at LoadX Factoring are working hard to help as many CoreFund clients as possible. Many of those we are trying to help are small 1 truck operators who are days away from closing down. We are in contact with the International Factoring Association, the largest factoring association in the world, and also the association that both CoreFund and we at LoadX Factoring are a part of. They are also attempting to help as much as they are able. We are also working on getting further guidance from an attorney who specializes in this industry.

Whether you do business with us at LoadX Factoring in the future or not, we are here to help as much as we can. Our President, Justin McKibben, has spent much of the weekend on the phone directly with carriers trying to help any way possible.

We also suggest you login to your CoreFund portal and download every report year to date, broker list, collection notes, etc that you can.

Disclaimer

Again, the information here should not be construed as legal advice, but only as our opinion on the matter. Please contact an attorney to help you in the matter if you are affected by this CoreFund shutdown.

We will continue to update this post with more information as we get it.

Stay in the loop